Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FTI affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction. Sonal Desai, Ph.D. is the executive vice president and chief investment officer for Franklin Templeton Fixed Income at Franklin Templeton.

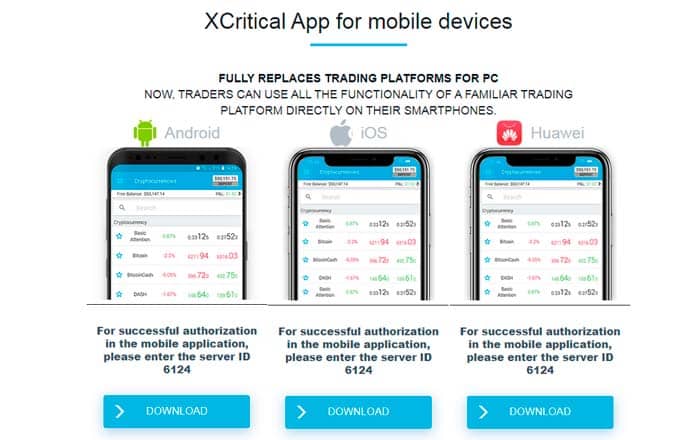

- In Forex trading, traders benefit from tight spreads from 0.1 pips.

- Finding a broker isn’t just a matter of picking up the phone and ringing the first one you saw on Google, or choosing one of the myriad online brokers that now exist.

- In this case, governments begin to run deficits and must naturally begin to search for more efficiency in all its public services, including policing.

- And if they want to give their clients a specific exposure, they will go to bank desks and look for products that are appropriately priced.

- In the so-called BitMEX Testnet, users can test and practice trading with leverage in the BitMEX trading system without burning their fingers in real.

In Forex trading, traders benefit from tight spreads from 0.1 pips. These are primarily used for major currency pairs such as EUR/USD. In the case of exotics, on the other hand, spreads are much higher, which is normal in Forex trading. According to our ThinkMarkets experience, the broker is also absolutely competitive in this area. The international Forex broker even allows cryptocurrency deposits – a feature that is not yet a standard among Forex brokers.

How can I invest in the stock market?

The company, however, said it expected a rise in fiscal 2023 earnings before interest, tax, SGARA and material items to between A$580 million and A$590 million ($393.41 million-$400.20 million), from A$523.7 million in the previous year. Treasury Wine estimated a 2%-3% drop in fiscal 2023 group net sales revenue, weighed down by a weaker performance of its Treasury Americas and Treasury Premium Brands. Customers of premium brands will continue to consume wine even during the cost of living crisis as opposed to budget-conscious consumers, said Carl Capolingua, a market analyst at thinkMarkets. “Wine is probably more of a luxury item rather than is thinkmarkets legit an essential. So, I think when consumers are feeling the cost of living crisis, they are going to be pulling back on certain items like wine,” said Josh Gilbert, a market analyst at eToro. The country’s biggest winemaker flagged challenging market conditions and consumption outlook for commercial wine, especially in Australia and the United Kingdom, and said it was undertaking a review of its domestic supply chain. There is simply no way that an institution set up to handle the security challenges of the 19th century industrial economy can continue to meet all of the security demands of a wildly changing, diversified modern global economy.

Friday’s Non-Farm Payroll report a make or break for markets – ThinkMarkets

Friday’s Non-Farm Payroll report a make or break for markets.

Posted: Thu, 06 Apr 2023 07:00:00 GMT [source]

Now, having said that, our most likely scenario is that we will reduce the target further and bring down price risk, but it’s going to depend on a lot of things. Most recently, Mark, as you alluded to, it got all the way up to 0.96. A lot of that, I think, was around election time, the market start to discount the blue wave, which at this point we haven’t had. Mind you in January, we’ll find out about the Senate, but at this time, it still looks like Republicans will keep the senate buy one seat. Hi Amit, it’s a tough time for credit card rewards junkies like myself.

Q1 2023 Market Update

We talked in a recent episode about how many Canadians still invest in high-fee actively-managed mutual funds. Maybe asking why investors invest in structured products is a silly question. While plenty of uncertainty and risks remain, the risk/reward profiles across a wide swath of the U.S. fixed income markets have rarely been more favorable for credit investors, in our view. With the Fed on deck to begin buying corporate and municipal bonds, we think investors should do the same. But I think, more seriously, structure products play – and it probably makes similar arguments for actively managed mutual funds actually. But they play on a few biases that are common among investors.

What are the 5 types of trading?

- Day Trading. Day trading, a.k.a. Intraday trading, is one of the most common types of trading in the stock market.

- Positional Trading.

- Swing Trading.

- Long-Term Trading.

- Scalping.

- Momentum Trading.

So I think it’s clear that central banks will likely be willing to step in, again, in such periods to support credit markets. What we’ve seen as Romas alluded to, was that central banks have expanded their toolkits to include corporate bond purchases. While we saw some other major central banks, notably the BOJ and the ECB make such moves earlier in the past decade. Really, it was the Fed’s decision to purchase corporate bonds in March and April that has had and will continue to have the most dramatic impact on financial markets. With reasonable assumptions about the underlying stocks expected returns, the mean expected return estimate on these structured products is slightly below zero. The products in that sample, they don’t provide tax liquidity or other benefits.

What is a stock market index?

And, again, that’s well documented in the household finance literature. Equity non-participation is a big thing in the household finance literature. But I think, as a generalization, most investors would be well-served to avoid them.

You cannot just jump into a sport car and start driving fast to anywhere, when you’ve never been driving before. The likelihood to cause an accident would be enourmously high. With trading it’s the same – you cannot just start and achieve profits all the time.

There are two types of stocks, which afford investors different rights:

After all, it is the clear market leader in Forex and CFD trading, which is offered by almost all brokers. The MetaTrader enables comprehensive technical analysis based on numerous indicators and charts. With the help of Expert Advisors, automated trading systems can be set up. I still think that the traditional portfolio theory in terms of diversification that you get from bonds is still important. To Romas’s point, I still think that that maybe is more prevalent here in North America with yield levels here that are materially higher than in maybe other jurisdictions around the globe.

What are the 4 types of traders?

- The Scalper.

- The Day Trader.

- The Swing Trader.

- The Position Trader.

How much is 1 lot in a micro account?

A micro lot represents 1,000 units of the base currency in a forex trade. The base currency is the first currency in a pair or the currency that one buys or sells.